November is usually a slow month for my income portfolio. Dividend/interest received is about SGD $2.9k and year to date dividend/interest income hit 68.9K. With 1 more months to go, I will be receiving > 70k total dividend/interest income for the full year exceeding my 2021 target.

However, my YTD portfolio return took a big hit toward the end of November as stock markets around the world took a big hit from a new Covid variant Omicron and FED talk of tapering. Overall portfolio return including dividend received is around 7.31% , a drop of 2% or a whopping $28k drop in just 1 month.

With the recent market crash, I continue to add another 17kUSD of BTI and MO which are currently giving an attractive yield on cost >8%. Basically, I am parking my cash in these tobacco stocks with sustainable high yield. The way I see it, their dividend yield is so high now, that even if the stock price falls further, with the dividend payouts received, it is a reasonable bet that I'll recover the total investment cost after a couple of years.

I also bought a couple of SGX reits like MIT and FCT. All these investment will boost my dividend income to more than 75k in 2022.

Dividends received in Nov2021 from Foreign Investment (Stocks): USD $1148

Interest received in Nov2021 from Foreign Investment (bonds): USD $212

Interest received in Nov2021 from banks interest/FD/others in US: USD $366

Realized gain/loss : Nil

Dividends received in Nov2021 from SGX: SGD $915

Interest received in Nov2021 from banks interest/FD/others in Spore: SGD $201

SGX Realized gain/loss: Nil

Total dividend and interest from my investment portfolio + bank/money market/retirement account + trading gain/loss generated in Nov2021 : SGD$3395

YTD Passive income earned from investment account only: SGD $66.58K

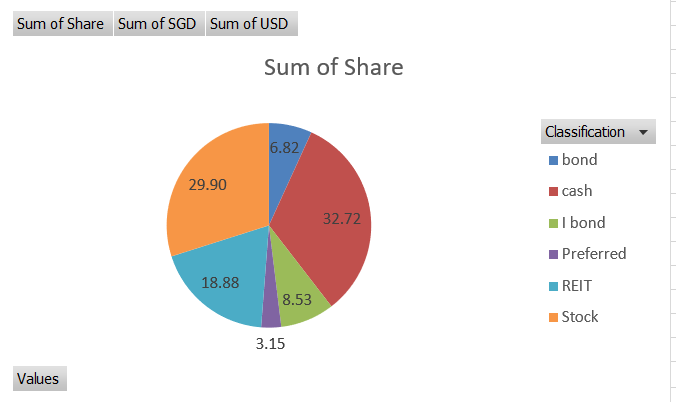

Investment Portfolio Monthly Dividend/Interest earned Y-to-Y changes from 2017 to 2021:

Counters from my investment portfolio contributing to monthly Dividend/Interest in Nov2021 :

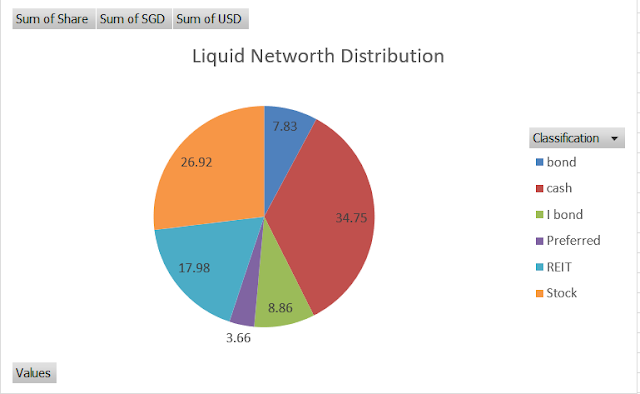

Liquid Networth distribution: