In the month of Jul, dividend/interest received is about 7.8K , this is the highest July investment income recorded in the last 4 years. However, my ytd portfolio gain decrease by $18k this month due to sharp correction on my HKSE holding. My portfolio have been hitting all time high every month since Jan and I have already anticipated correction could be coming soon. The only saving grace is that I received a good amount of dividend to weather the storm. Even though, my holding in China Tech stock is relatively small but the entire HKSE index was badly impacted by the HKSE Tech Stocks crashed. My HKSE holding went from an ATH unrealized gain of 15% to 0% within a short 3 months. This shows how volatile overseas stock market can be. However, as most of my holding are large cap state own money with good dividend, I am confident the portfolio value will recover again. I continue to increase my stake in current HKSE holding with my dividend received.

Dividends received in Jul2021 from Foreign Investment (Stocks): USD $4568

Interest received in Jul2021 from Foreign Investment (bonds): USD $957

Interest received in Jul2021 from banks interest/FD/others in US: USD $411

Realized gain/loss : USD 3659

Dividends received in Jul2021 from SGX: SGD $266

Interest received in Jul2021 from banks interest/FD/others in Spore: SGD $204

SGX Realized gain/loss: Nil

Total dividend and interest from my investment portfolio + bank/money market/retirement account + trading gain/loss generated in Jul2021 : SGD$ 13.1K

YTD Passive income earned from investment account only: SGD $41.6K

Investment Portfolio Monthly Dividend/Interest earned Y-to-Y changes from 2017 to 2021:

Counters from my investment portfolio contributing to monthly Dividend/Interest in Jul2021 :

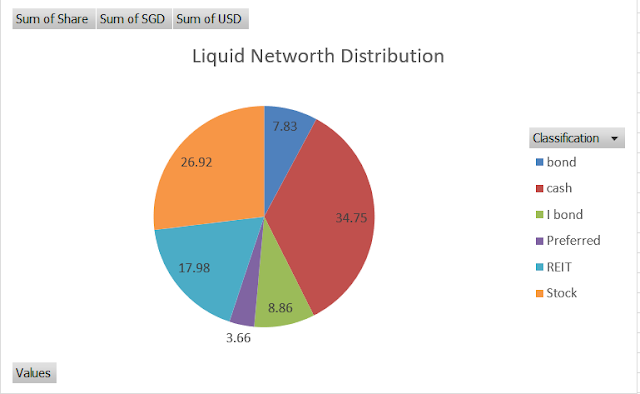

Liquid Networth distribution: