January Dividend/interest received is about SGD $5k.

YTD Investment gain/loss: 2.5%

YTD Networth growth: 0.43%

January Investment gain is flat due to drag down by SGX Reits and networth growth mainly from salary saved and dividend/interest received. Not a bad outcome as January markets was really turbulent with threat of rising interest rate.

Another bond was called and released USD12.5K of cash flow. I converted them to HKD and have increased my investment in a few HKSE dividend stocks in January with 10K USD on 8.hk, 5k USD on 1313.hk and 6.2k USD on 2386.hk. All three HKSE dividend stocks have 8% or more yield. I have also invested 1k CAD on ZWC.TO which is a Canadian bank ETF with call option.

On the SGX side, I have added about 9.5k SGD Ascendas I-Trust. With SGX Reits down to 52 weeks low, I will start increasing my stakes in the coming months.

The new investment will boost my annual dividend income close to 76K in 2022.

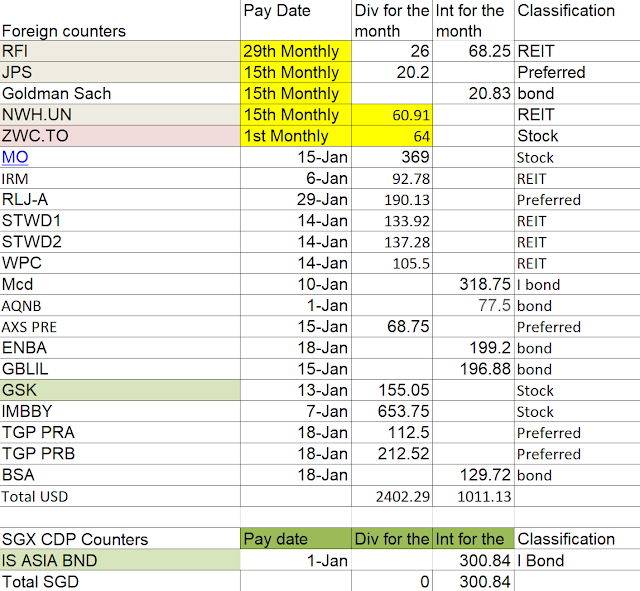

Dividends received in Jan2022 from Foreign Investment (Stocks): USD $2402

Interest received in Jan2022 from Foreign Investment (bonds): USD $1011

Interest received in Jan2022 from banks interest/FD/others in US: USD $350

Realized gain/loss : USD 2308

Dividends received in Jan2022 from SGX: SGD $300.84

Interest received in Jan2022 from banks interest/FD/others in Spore: SGD $196

SGX Realized gain/loss: Nil

Total dividend and interest from my investment portfolio + bank/money market/retirement account + trading gain/loss generated in Jan2022: SGD$8634

2022 Dividend earned from investment account only: SGD $4874

2017 to 2021 Monthly Dividend/Interest earned from Investment Portfolio :

Counters from my investment portfolio contributing to monthly Dividend/Interest in Jan2022 :

Liquid Networth distribution: