December Dividend/interest received is about SGD $4.9k and this brings my 2021 annual dividend/interest income to $74.3K. Total 2021 return is $140K. 2021 investment income received increased by 26% compared to 2020 and it was the highest since I took up dividend investment from 2016. From my annual Dividend/Interest Income chart in the last 10 years, it can be seen that my saving return was languishing at low 10k annually prior to 2016. My current investment portfolio yield is around 6%.

I have been increasing my investment (about 60k) in dividend stocks throughout Oct to Dec during the market downturn, I am projecting my investment income to hit 77k in 2022. As I still have significant cash holding and cash flow from my dividend, I will be looking for more opportunities in 2022 to add more dividend stocks to boost my investment income up to 80k .

2021 investment portfolio total return including dividend received is around 8.9% . This is more or less within my expectation as my investment strategy is to get stable passive income after retirement. While my US bond and LSE portfolios are doing ok in 2021, my investment overall performance was still dragged down by HKSE counters which contribute 22% of my portfolio. Another drag was a complete write off of EHT from my SGX portfolio after it declared bankrupt this year with unitholders equity completely wiped off. Since the 2020 covid crisis hit my portfolio hard, I have since taken drastic steps to reduce high risk low quality stocks from my portfolio by selling off almost 500k in 2020 and replacing them with the same amount of more stable index dividend stocks. My current investment portfolio now consist of 75% companies with investment grade credit rating. This action has help me to obtain a more sustainable dividend income and stable capital appreciation in 2021.

Lastly, my liquid net worth (excluding CPF and properties) has increased by 14% in 2021.

2017 to 2021 Monthly Dividend/Interest earned from Investment Portfolio :

Annual Dividend/Interest Income and % change in the last 10 years

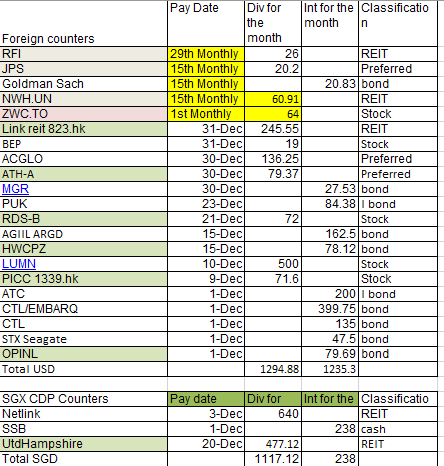

Dividends received in Dec2021 from Foreign Investment (Stocks): USD $1295

Interest received in Dec2021 from Foreign Investment (bonds): USD $1235

Interest received in Dec2021 from banks interest/FD/others in US: USD $366

Realized gain/loss : USD -$4018

Dividends received in Dec2021 from SGX: SGD $1355

Interest received in Dec2021 from banks interest/FD/others in Spore: SGD $199

SGX Realized gain/loss: Nil

Total dividend and interest from my investment portfolio + bank/money market/retirement account + trading gain/loss generated in Dec2021 : SGD$75

2021 Dividend earned from investment account only: SGD $71275

Counters from my investment portfolio contributing to monthly Dividend/Interest in Dec2021 :

Liquid Networth distribution:

Portfolio top 5 sectors (Reits 32%, Telecom 18%, Finance 17%,Consumer 10% and Energy 8%)

I see you have foreign stocks for dividend. Is it worth it after 30% tax? I wonder why you pick the stocks instead of buying income funds that yield 8-9%?

ReplyDeleteYes , all US listed stocks have WHT unless it is ADR or incorporated in another country. I have a US retirement account from a previous job there.. I only hold US stocks in that account which is tax free.

Delete